As cryptocurrencies gain widespread adoption and acceptance, the need for a more stable form of digital currency has become increasingly important. That's where stablecoins come in - a type of cryptocurrency designed to be less volatile and maintain a stable value. In this article, we will take a closer look at stablecoins, how they work, and why they are becoming more popular.

What is a Stablecoin?

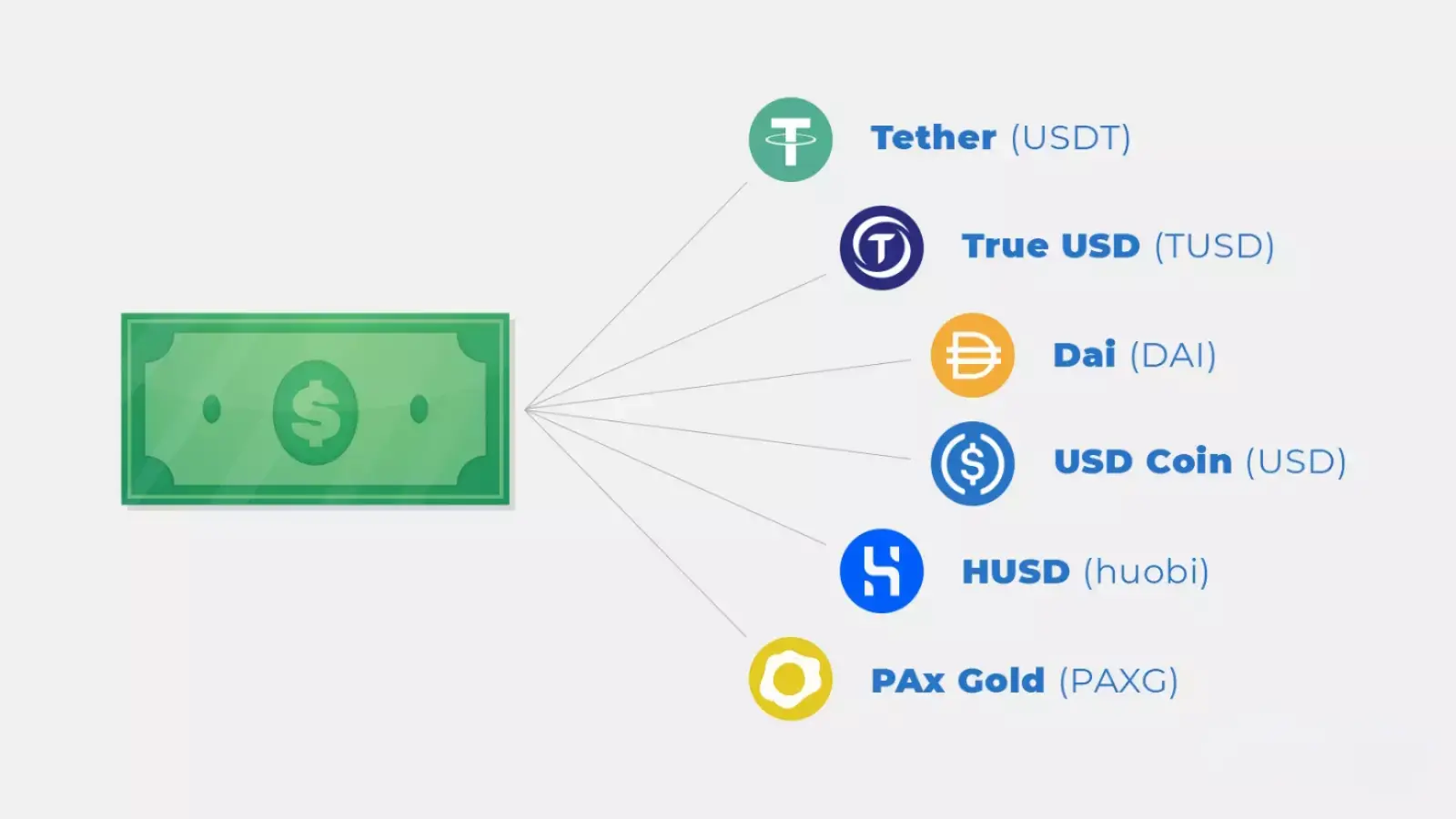

Stablecoins are a type of cryptocurrency that have been created to provide a more stable value compared to traditional cryptocurrencies such as Bitcoin or Ethereum. This stability is achieved by pegging the value of the stablecoin to an asset or a basket of assets that have a stable value, such as the US dollar, euro, or gold. By tying the value of the stablecoin to the underlying asset, the stablecoin is less likely to experience the price fluctuations that are common in traditional cryptocurrencies. Stablecoins provide a less volatile alternative to traditional cryptocurrencies and have several advantages including investment opportunities, decentralized finance transactions, and cross-border payments.

How do Stablecoins Work?

Stablecoins work by being pegged to a stable asset or a basket of assets, such as the US dollar, euro, or gold. The value of the stablecoin is then linked to the value of the underlying asset, which provides stability and lessens volatility. For example, if a stablecoin is pegged to the US dollar, then the value of the stablecoin will be equal to one US dollar. This means that for every stablecoin that is created, there must be an equivalent amount of the underlying asset held in reserve.

Stablecoins can be created in different ways, depending on the specific type of stablecoin. One common method is to use fiat-backed stablecoins, which are backed by a reserve of fiat currency, such as the US dollar. Another method is to use commodity-backed stablecoins, which are backed by commodities like gold or silver. There are also algorithmic stablecoins, which use complex algorithms to maintain price stability without being backed by any asset. These algorithmic stablecoins adjust their supply and demand to maintain a stable price, but they can be more complex and difficult to understand than other types of stablecoins.

Overall, the main purpose of stablecoins is to provide a more stable and predictable cryptocurrency for investors and users. They can be used for various applications, such as making cross-border payments, facilitating decentralized finance transactions, and providing a stable store of value for investors.Another type of stablecoin is the crypto-collateralized stablecoin, which is backed by a reserve of other cryptocurrencies. These stablecoins use smart contracts and algorithms to maintain their stability, and their value is determined by the value of the underlying collateral.

Why are Stablecoins Becoming More Popular?

Stablecoins are becoming more popular for several reasons. Firstly, stablecoins provide a more stable alternative to traditional cryptocurrencies, which can be highly volatile and subject to significant price fluctuations. Stablecoins offer a more predictable and stable investment option, making them more appealing to risk-averse investors.

Stablecoins are also becoming more popular in the world of decentralized finance (DeFi), where they are used to facilitate transactions and trading on decentralized exchanges (DEXs). Stablecoins provide a stable and convenient way to transact in the DeFi ecosystem without the risk of significant price fluctuations.

Finally, stablecoins are becoming more popular due to their potential use in cross-border transactions. As stablecoins are not tied to a particular jurisdiction or currency, they offer a more efficient and cost-effective way to transfer funds across borders.

Conclusion

Stablecoins provide a stable and less volatile alternative to traditional cryptocurrencies and offer several benefits in terms of investment, DeFi transactions, and cross-border payments. As cryptocurrencies continue to gain widespread acceptance and adoption, stablecoins are likely to play an increasingly important role in the digital currency landscape.