As the world becomes increasingly digitized, cryptocurrencies are gaining popularity among investors and traders. With their decentralized nature and unique features, cryptocurrencies have the potential to revolutionize the financial world. One of the interesting features of certain cryptocurrencies is deflationary mechanics, which can have both positive and negative impacts on the market. In this article, we will explore the concept of deflationary in crypto and its impact on the market.

What is Deflationary in Crypto?

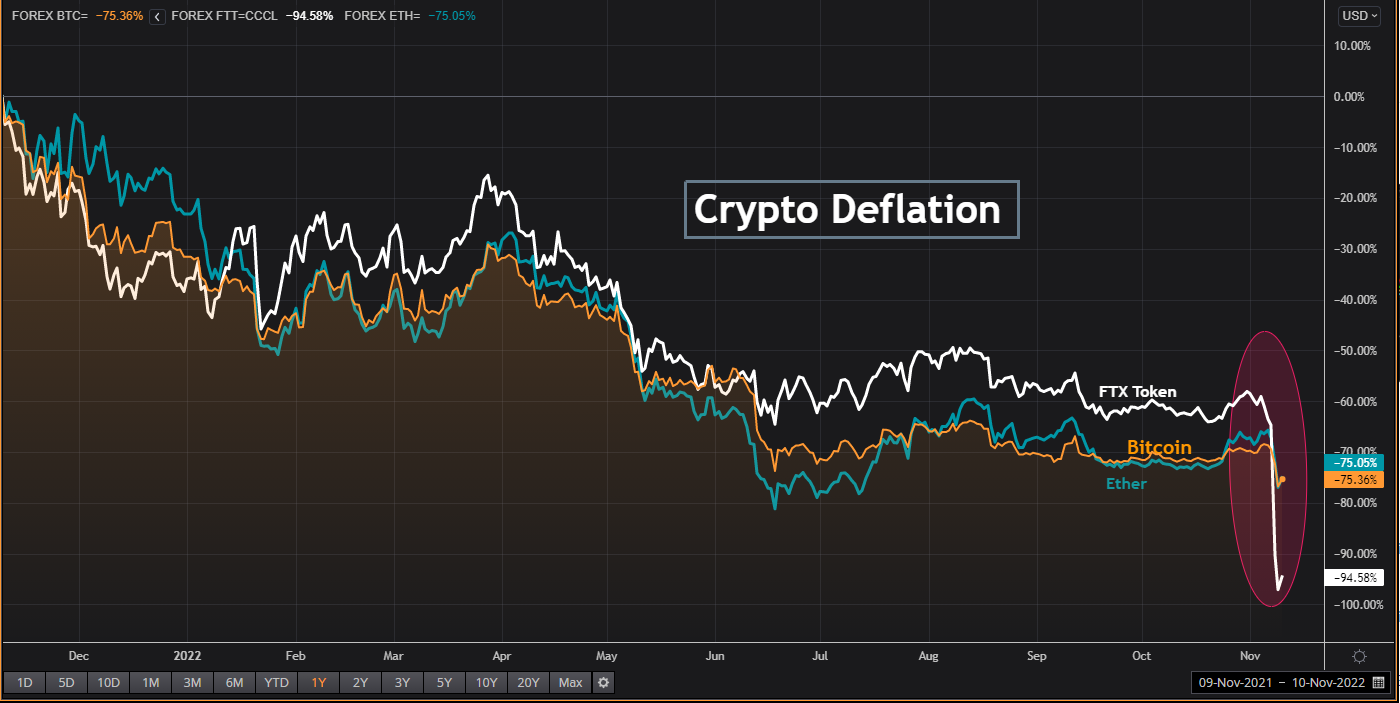

Deflationary cryptocurrencies are those that have a limited supply cap. This means that there will be a finite number of coins or tokens in circulation, and no new coins will be added. Bitcoin, the world's first and most popular cryptocurrency, is deflationary, as it has a maximum supply of 21 million coins. Ethereum, the second-largest cryptocurrency by market cap, is currently inflationary, as there is no supply cap. However, Ethereum is planning to transition to a deflationary model with the upcoming Ethereum 2.0 upgrade.

Impact of Deflationary Mechanics on Crypto Market:

There are several impacts of deflationary mechanics on the crypto market, including:

1. Scarcity and Increased Value:

With a limited supply of coins, deflationary cryptocurrencies can become more valuable as demand increases. This is because scarcity leads to higher demand, and higher demand leads to higher prices. As a result, investors and traders may be more interested in deflationary cryptocurrencies as a long-term investment.

2. Reduced Inflation:

Inflation is a measure of the rate at which prices for goods and services rise over time. Deflationary cryptocurrencies can help to reduce inflation, as there is a limited supply of coins, which means that the purchasing power of each coin can increase over time. This can be beneficial for holders of deflationary cryptocurrencies who want to protect their wealth from inflation.

3.Potential for Hoarding:

Deflationary cryptocurrencies may encourage hoarding, as investors and traders may hold onto their coins in anticipation of future price increases. This can lead to reduced liquidity in the market, which can make it difficult for traders to buy and sell coins. Additionally, hoarding can lead to increased volatility in the market, as sudden sell-offs by hoarders can result in rapid price drops.

4. Reduced Adoption:

Deflationary cryptocurrencies may also lead to reduced adoption, as they may not be as useful for everyday transactions. If the value of a coin is constantly increasing, it may not make sense for people to use it for small transactions, as the value of the coin may have changed significantly by the time the transaction is confirmed. This can limit the practical applications of deflationary cryptocurrencies and reduce their overall adoption.

Conclusion:

Deflationary cryptocurrencies are a unique and interesting feature of the crypto market. While they can offer several benefits, including increased value and reduced inflation, they can also lead to hoarding, reduced liquidity, and reduced adoption. As with any investment, it is important to carefully consider the potential risks and rewards of deflationary cryptocurrencies before investing.